The Logan County Chamber of Commerce held its monthly Business Impact meeting Wednesday morning at Mary Rutan Health.

Local officials spoke to a packed audience about proposed property tax legislation currently awaiting a decision from Governor Mike DeWine.

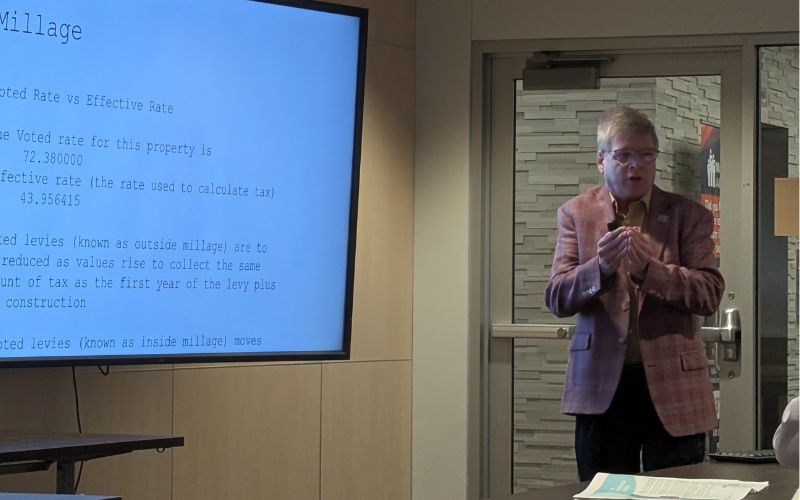

Logan County Auditor Jack Reser, Commissioner Mike Yoder, and Treasurer Rhonda Stafford outlined several key bills that could affect property taxes across the county:

- House Bill 335 – Reduces or eliminates automatic inside-millage increases for local governments and schools.

- House Bill 309 – Gives county budget commissions the authority to cut overly excessive levy collections.

- House Bill 186 – Caps property tax revenue for 20-mill floor school districts to prevent spikes from rising property values.

- House Bill 129 – Recalculates school property taxes by adding fixed levies to the 20-mill formula to prevent sudden tax hikes.

The trio said that Governor DeWine has 10 days to either sign the bills into law or veto them.

Until then, residents and local governments will be waiting to see how these changes could affect taxes in the coming year.

Stafford talks more about what could be coming to your tax bill:

The chamber meeting offered local business leaders and school officials in attendance a chance to ask questions and better understand how the legislation could impact property taxes in Logan County.